Companies and activities

Bank Package I (Bank Package): For the period from October 2008 to 30 September 2010, the Danish State guaranteed timely payment of unsecured creditors’ claims against Danish banks paying guarantee commission.

Bank Package III (Exit Package): Guarantee was again only provided for up to EUR 100,000 for depositors. Failing banks could elect to be resolved by Finansiel Stabilitet, and in such case the former Guarantee Fund would provide a loss guarantee to prevent the Danish State from incurring losses in connection with the resolution.

Bank Package IV (Consolidation Package): Finansiel Stabilitet and the former Guarantee Fund could contribute a dowry if a viable bank took over all (model 1) or parts (model 2) of a failing bank. This was done without any loss being incurred by uncovered, unsecured creditors. Individual government guarantees could be extended after the expiry in 2013 in case of merger/takeover between two banks.

Other areas:

Debt counselling for former mink farmers: On 1 June 2021, the Danish parliament passed an Act to amend the Act on Restructuring and Resolution of Certain Financial Enterprises, under which Finansiel Stabilitet is required to set up an entity to provide debt counselling free of charge to former mink farmers.

Government-guaranteed mortgage credit agreements in rural districts: On 7 June 2022, the Danish parliament passed an act on the establishment of a government guarantee on a part of the mortgage credit agreements in rural districts. Finansiel Stabilitet manages the government guarantee scheme on behalf of the Danish State.

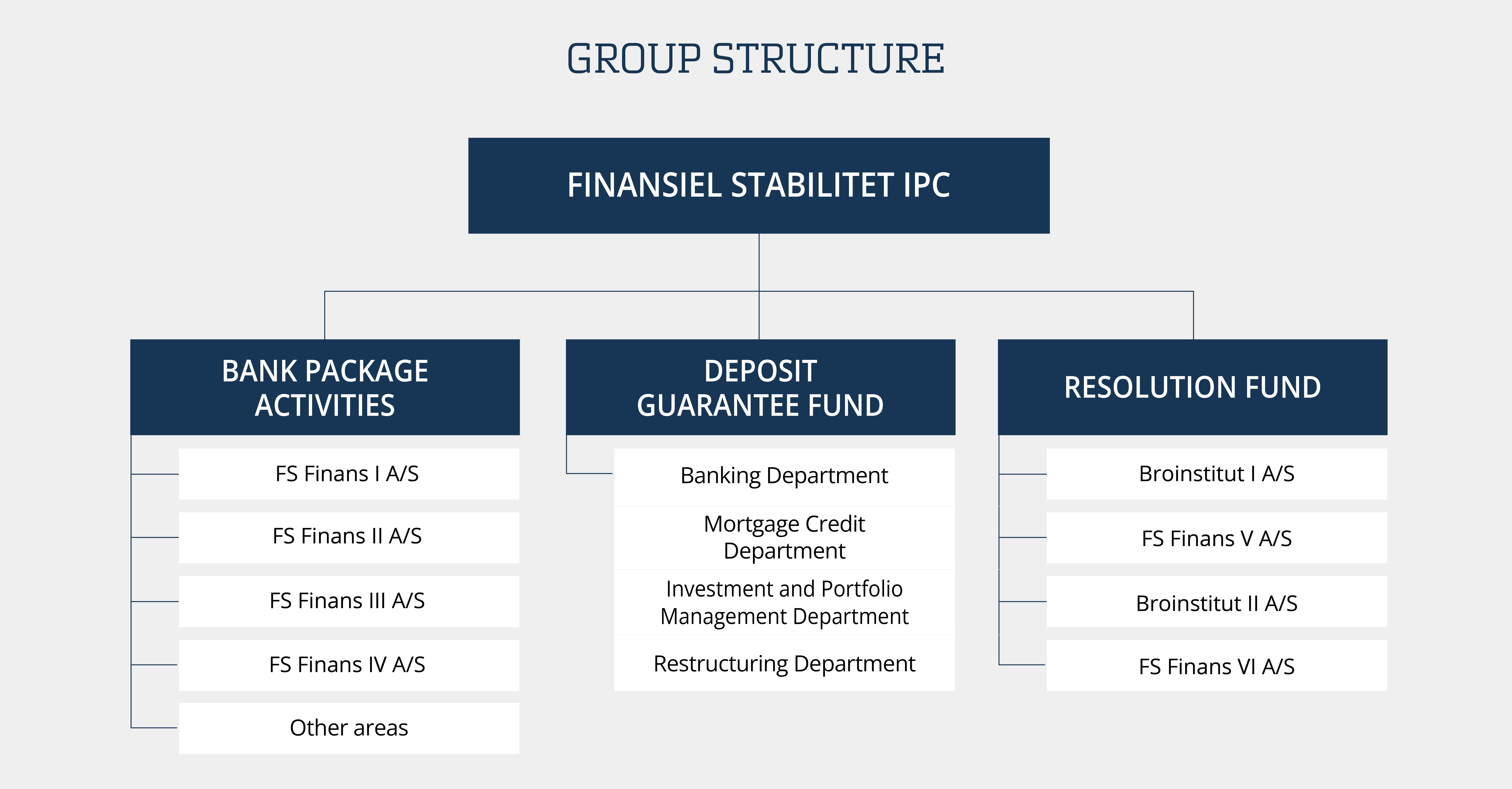

FS Finans I A/S: Financing company established on 28 September 2012 based on Sparebank Østjylland af 2012 A/S after the company had deposited its banking licence with the Danish FSA.

FS Finans II A/S: Financing company established on 1 November 2012 based on Max Bank af 2011 A/S after the company had deposited its banking licence with the Danish FSA.

FS Finans III A/S: Financing company established on 15 March 2013 based on Amagerbanken af 2011 A/S after the company had deposited its banking licence with the Danish FSA.

FS Finans IV A/S: Financing company established on 27 March 2013 based on Fjordbank Mors af 2011 A/S after the company had deposited its banking licence with the Danish FSA.

Deposit Guarantee Fund: By Act no. 334 of 31 March 2015, the Guarantee Fund for Depositors and Investors was dissolved effective from 1 June 2015. The rights and obligations of the former Guarantee Fund were continued under the new Deposit Guarantee Fund, managed by Finansiel Stabilitet. The Deposit Guarantee Fund consists of four funds: the Banking Department, the Mortgage Credit Department, the Investment and Portfolio Management Department and the Restructuring Department.

Resolution Fund: By adoption of the Act on Restructuring and Resolution of Certain Financial Enterprises, a resolution financing scheme (the Resolution Fund) was established, which is managed by Finansiel Stabilitet. The Resolution Fund may be used in connection with Finansiel Stabilitet’s powers to implement resolution measures against businesses that are failing or are expected to fail and where it is in the public interest to do so.

Broinstitut I A/S: Subsidiary under the Resolution Fund whose objects are to own shares in FS Finans V A/S.

FS Finans V A/S: Financing company established on 31 May 2017 based on Andelskassen J.A.K. Slagelse after the company had deposited its banking licence with the Danish FSA.

Broinstitut II A/S: Subsidiary under the Resolution Fund whose objects are to own shares in FS Finans VI A/S.

FS Finans VI A/S: Financing company established on 28 June 2019 based on Københavns Andelskasse after the company had deposited its banking licence with the Danish FSA.