GROUP STRUCTURE

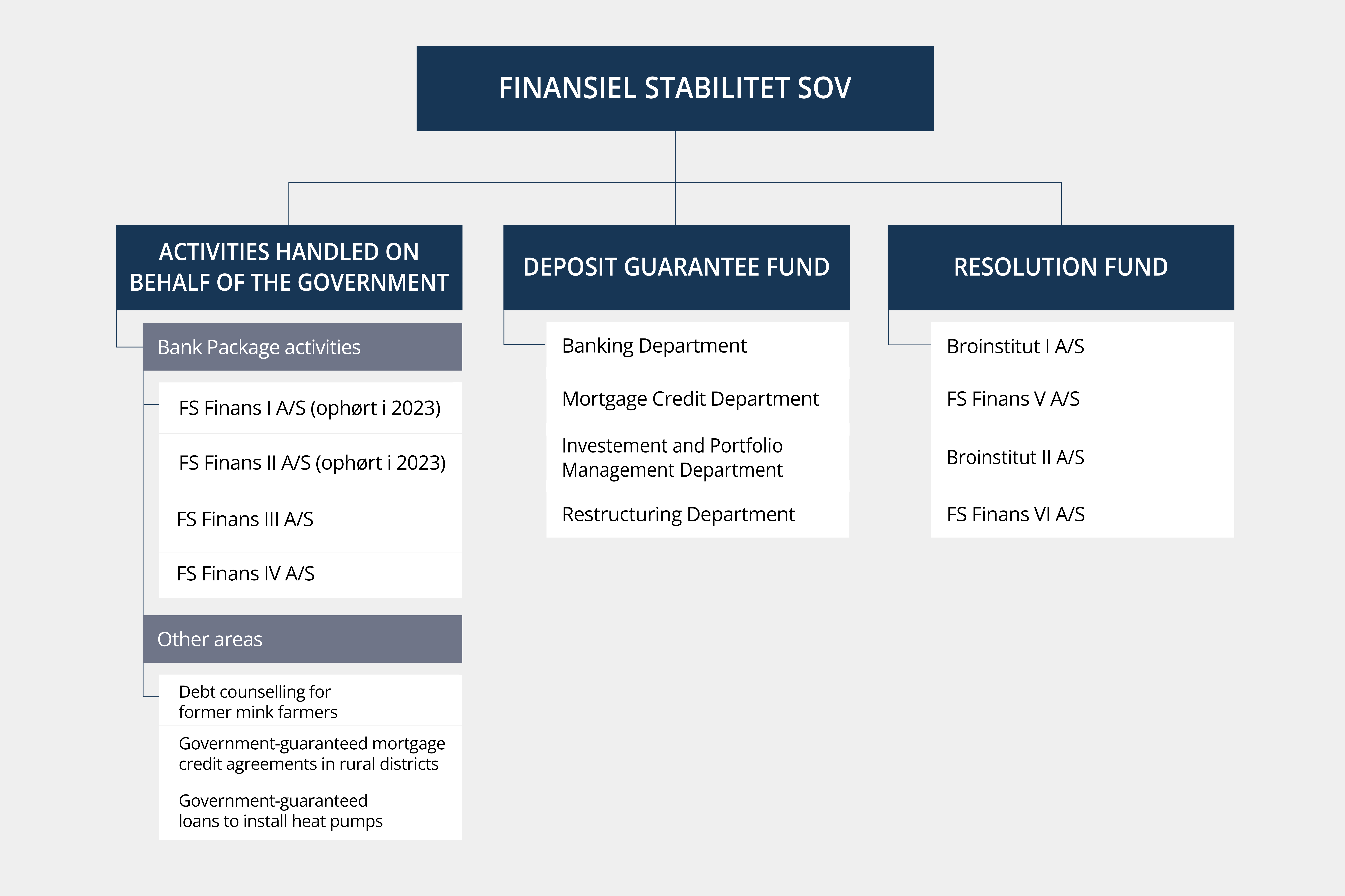

Finansiel Stabilitet is organised with three business areas that are based on the main objectives, Activities handled on behalf of the government, the Deposit Guarantee Fund and the Resolution Fund, as illustrated in the figure below:

Companies and activities

ACTIVITIES HANDLED ON BEHALF OF THE GOVERNMENT:

Bank Package activities:

Bank Package I (Bank Package): For the period from October 2008 to 30 September 2010, the Danish State guaranteed timely payment of unsecured creditors’ claims against Danish banks paying guarantee commission under the scheme.

Bank Package III (Exit Package): Guarantee was again only provided for up to EUR 100,000 for depositors. Failing banks were generally resolved via Finansiel Stabilitet, and in such case the former Guarantee Fund would contribute a loss guarantee to prevent the Danish State from incurring losses in connection with the resolution.

Bank Package IV (Consolidation Package): Finansiel Stabilitet and the former Guarantee Fund contributed a dowry if a viable bank took over all (model 1) or parts (model 2) of a failing bank. This was done without any loss being incurred by uncovered, unsecured creditors. Individual government guarantees were extended after the expiry in 2013 in case of merger/takeover between two banks. In connection with the solvent liquidation of FS Finans I A/S and FS Finans II A/S in 2023, no banks taken over under Bank Package IV remained.

FS Finans III A/S: Financing company established on 15 March 2013 based on Amagerbanken af 2011 A/S after the company had deposited its banking licence with the Danish FSA.

FS Finans IV A/S: Financing company established on 27 March 2013 based on Fjordbank Mors af 2011 A/S after the company had deposited its banking licence with the Danish FSA.

Other areas:

This segment covers other activities handled on behalf of the government, for the account and risk of the government.

Debt counselling for former mink farmers: On 1 June 2021, the Danish parliament passed an Act to amend the Act on Restructuring and Resolution of Certain Financial Enterprises, under which Finansiel Stabilitet is required to set up an entity to provide debt counselling free of charge to former mink farmers.

Government-guaranteed mortgage credit agreements in rural districts: On 7 June 2022, the Danish parliament adopted an act on the establishment of a government guarantee on part of the mortgage credit agreements in rural districts. Finansiel Stabilitet manages the government guarantee scheme on behalf of the Danish State.

Government-guaranteed loans to install heat pumps: On 24 March 2023, the Danish parliament adopted an act on the establishment of a government guarantee on loans for the replacement of oil or gas-fired furnaces in rural districts. Finansiel Stabilitet manages the government guarantee scheme on behalf of the Danish State.

Assets taken over from mink-related industries: Pursuant to the Executive Order on the scheme for the sale and other management of assets taken over from mink-related industries, Finansiel Stabilitet is to assist the government with the management and sale of assets arising from mink-related industries which have received government compensation. The scheme is established in the subsidiary FS Ejendomsselskab A/S for the account and risk of the government.

DEPOSIT GUARANTEE FUND:

By Act no. 334 of 31 March 2015, the Guarantee Fund for Depositors and Investors was dissolved effective from 1 June 2015. The rights and obligations of the former Guarantee Fund were continued under the new Deposit Guarantee Fund, managed by Finansiel Stabilitet. The Deposit Guarantee Fund consists of four funds: the Banking Department, the Mortgage Credit Department, the Investment and Portfolio Management Department and the Restructuring Department.

RESOLUTION FUND:

By adoption of the Act on Restructuring and Resolution of Certain Financial Enterprises, a resolution financing scheme (the Resolution Fund) was established, which is managed by Finansiel Stabilitet. The Resolution Fund may be used in connection with Finansiel Stabilitet’s powers to implement resolution measures against businesses that are failing or are expected to fail and where it is in the public interest to do so.

Broinstitut I A/S: Subsidiary under the Resolution Fund whose objects are to own shares in FS Finans V A/S.

FS Finans V A/S: Financing company established on 31 May 2017 based on Andelskassen J.A.K. Slagelse after the company had deposited its banking licence with the Danish FSA.

Broinstitut II A/S: Subsidiary under the Resolution Fund whose objects are to own shares in FS Finans VI A/S.

FS Finans VI A/S: Financing company established on 28 June 2019 based on Københavns Andelskasse after the company had deposited its banking licence with the Danish FSA.